Multiple Choice

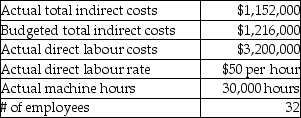

Use the information below to answer the following question(s) .The following data were taken from the records of Big Sky Ltd., a manufacturing company.The company has been calculating the actual indirect cost allocation rate using direct labour hours as the allocation base.

-Normandeau Company's actual indirect cost pool amounted to $1,400,000 and the direct labour pool was $5,400,000.Overhead is allocated on the basis of direct labour hours.Actual and budgeted direct labour hours were 25,000 and 30,000 for the period.What is the manufacturing overhead cost allocation rate using actual direct labour hours as the cost allocation base?

A) $46.67

B) $272.00

C) $75.00

D) $226.67

E) $56.00

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Why does the Manufacturing Overhead Control account

Q10: For each item below indicate the source

Q11: A materials requisition record and a labour

Q12: The Dougherty Furniture Company manufactures tables.In March,

Q14: Northern Manufacturing uses a predetermined manufacturing overhead

Q15: Use the information below to answer the

Q16: LeBlanc Company has the following balances as

Q17: Hill Manufacturing uses departmental cost driver rates

Q18: The objective of allocating indirect costs is

Q128: At the end of the year,the direct