Multiple Choice

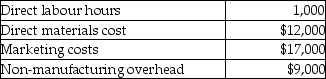

XYZ Company uses a normal job costing system.The direct labour rate is $27 per hour; and, the budgeted indirect cost allocation rate is $20 and uses direct labour hours as the cost allocation base.  What amount should be added to Work-in-Process control?

What amount should be added to Work-in-Process control?

A) $12,000

B) $47,000

C) $59,000

D) $76,000

E) $85,000

Correct Answer:

Verified

Correct Answer:

Verified

Q17: Hill Manufacturing uses departmental cost driver rates

Q18: The objective of allocating indirect costs is

Q19: For each cost pool, the indirect cost

Q21: Fox Manufacturing is a small textile manufacturer

Q23: LaFleur Company has the following balances as

Q24: Use the information below to answer the

Q25: A local financial consulting firm employs 30

Q26: A machine shop has direct materials cost

Q27: Use the information below to answer the

Q114: For normal costing, even though the budgeted