Multiple Choice

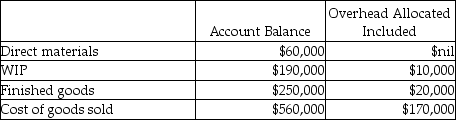

Use the information below to answer the following question(s) .Because the Abernathy Company used a budgeted indirect cost allocation rate for its manufacturing operations, the amount allocated ($200,000) was different from the actual amount incurred ($225,000) .These were the respective ending balances in the Manufacturing Overhead Allocated and Manufacturing Overhead control accounts.Before disposition of under/overallocated overhead, the following information was available:

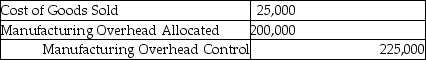

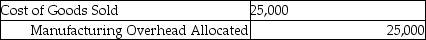

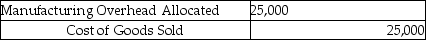

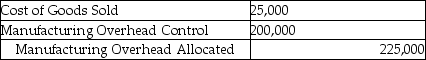

-What is the journal entry Abernathy Company should use to write-off the difference between allocated and actual overhead directly to cost of goods sold?

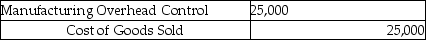

A)

B)

C)

D)

E)

Correct Answer:

Verified

Correct Answer:

Verified

Q64: The Work-in-Process Control account tracks job costs

Q71: What are three possible ways to dispose

Q151: Actual costing systems are commonly found in

Q152: Budgeted fixed indirect costs remain constant at

Q154: Which method for dealing with under/over allocated

Q156: A process costing system assigns costs to

Q157: Which of the following would be appropriately

Q158: Process costing is a useful system for

Q160: Manufacturing overhead costs incurred for the month

Q161: Sanders Company has two departments, X and