Multiple Choice

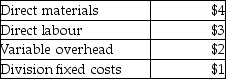

Answer the following question(s) using the information below.Beta Shoe Ltd.manufactures only one type of shoe and has two divisions, the Sole Division, and the Assembly Division.The Sole Division manufactures soles for the Assembly Division, which completes the shoe and sells it to retailers.The Sole Division "sells" soles to the Assembly Division.The market price for the Assembly Division to purchase a pair of soles is $20.(Ignore changes in inventory.) The per unit fixed costs are based on a production of 60,000 pairs of shoes.Sole's costs per pair of soles are:

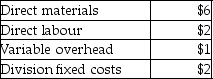

Assembly's costs per completed pair of shoes are:

Assembly's costs per completed pair of shoes are:

-Assume the transfer price for a pair of soles is 180% of total costs of the Sole Division and 40,000 of soles are produced and transferred to the Assembly Division.The Sole Division's operating income is

A) $300,000.

B) $320,000.

C) $248,000.

D) $440,000.

E) $400,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: If the product sold between divisions has

Q93: Explain what transfer prices are, and what

Q100: Hendricks Ltd.of Calgary manufactures and sells computers.The

Q101: For each of the following activities, characteristics,

Q102: A Canadian company has subsidiaries in France,

Q103: River Road Paint Company has two divisions.The

Q104: Examples of market-based transfer prices include variable

Q106: Use the information below to answer the

Q108: Use the information below to answer the

Q110: For each of the following transfer price