Multiple Choice

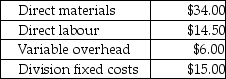

Answer the following question(s) using the information below.Cool Air Ltd.manufactures only one type of air conditioner and has two divisions, the Compressor Division, and the Assembly Division.The Compressor Division manufactures compressors for the Assembly Division, which completes the air conditioner and sells them to retailers.The Compressor Division "sells" compressors to the Assembly Division.The market price for the Assembly Division to purchase a compressor is $77.(Ignore changes in inventory.) The fixed costs for the Compressor Division are assumed to be the same over the range of 5,000-10,000 units.The fixed costs for the Assembly Division are assumed to be $15.00 per unit at 10,000 units.Compressor's costs per compressor are:

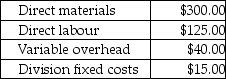

Assembly's costs per completed air conditioner are:

Assembly's costs per completed air conditioner are:

-What is the market-based transfer price per compressor from the Compressor Division to the Assembly Division?

A) $34.00

B) $54.50

C) $69.50

D) $77.00

E) $115.50

Correct Answer:

Verified

Correct Answer:

Verified

Q93: Explain what transfer prices are, and what

Q110: For each of the following transfer price

Q111: A product is know as _ when

Q112: In a time of distress prices, which

Q113: The Home Office Company makes all types

Q115: The Brownshoe Company has three specialized divisions.The

Q116: For each of the following activities, characteristics,

Q117: Use the information below to answer the

Q118: Use the information below to answer the

Q119: For each of the following transfer price