Multiple Choice

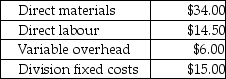

Answer the following question(s) using the information below.Cool Air Ltd.manufactures only one type of air conditioner and has two divisions, the Compressor Division, and the Assembly Division.The Compressor Division manufactures compressors for the Assembly Division, which completes the air conditioner and sells them to retailers.The Compressor Division "sells" compressors to the Assembly Division.The market price for the Assembly Division to purchase a compressor is $77.(Ignore changes in inventory.) The fixed costs for the Compressor Division are assumed to be the same over the range of 5,000-10,000 units.The fixed costs for the Assembly Division are assumed to be $15.00 per unit at 10,000 units.Compressor's costs per compressor are:

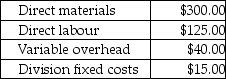

Assembly's costs per completed air conditioner are:

Assembly's costs per completed air conditioner are:

-What is the transfer price per compressor from the Compressor Division to the Assembly Division if the method used to place a value on each compressor is 150% of variable costs?

A) $81.75

B) $77.00

C) $9.00

D) $72.75

E) $51.00

Correct Answer:

Verified

Correct Answer:

Verified

Q24: Stavanger Ltd.is a Canadian company with a

Q25: Discuss some of the recent legislation and

Q26: For each of the following transfer price

Q27: Use the information below to answer the

Q28: Products transferred between subunits within an organization

Q30: Use the information below to answer the

Q31: Walton Industries has two divisions: Machining and

Q32: Briefly describe the arm's length principle and

Q33: For each of the following transfer price

Q34: Use the information below to answer the