Multiple Choice

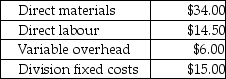

Answer the following question(s) using the information below.Cool Air Ltd.manufactures only one type of air conditioner and has two divisions, the Compressor Division, and the Assembly Division.The Compressor Division manufactures compressors for the Assembly Division, which completes the air conditioner and sells them to retailers.The Compressor Division "sells" compressors to the Assembly Division.The market price for the Assembly Division to purchase a compressor is $77.(Ignore changes in inventory.) The fixed costs for the Compressor Division are assumed to be the same over the range of 5,000-10,000 units.The fixed costs for the Assembly Division are assumed to be $15.00 per unit at 10,000 units.Compressor's costs per compressor are:

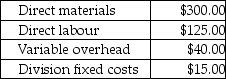

Assembly's costs per completed air conditioner are:

Assembly's costs per completed air conditioner are:

-Assume the transfer price for a compressor is 150% of total costs of the Compressor Division and 1,000 of the compressors are produced and transferred to the Assembly Division.The Compressor Division's operating income is

A) $31,750.

B) $32,750.

C) $34,750.

D) $36,500.

E) $49,750.

Correct Answer:

Verified

Correct Answer:

Verified

Q73: In the short run, the manager of

Q74: Use the information below to answer the

Q75: For each of the following transfer price

Q76: Management control systems collect which type of

Q77: For each of the following activities, characteristics,

Q79: Which of the following statements is FALSE?<br>A)A

Q80: Use the information below to answer the

Q81: Use the information below to answer the

Q82: For each of the following activities, characteristics,

Q83: An informal management control systems includes specific