Multiple Choice

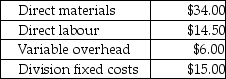

Answer the following question(s) using the information below.Cool Air Ltd.manufactures only one type of air conditioner and has two divisions, the Compressor Division, and the Assembly Division.The Compressor Division manufactures compressors for the Assembly Division, which completes the air conditioner and sells them to retailers.The Compressor Division "sells" compressors to the Assembly Division.The market price for the Assembly Division to purchase a compressor is $77.(Ignore changes in inventory.) The fixed costs for the Compressor Division are assumed to be the same over the range of 5,000-10,000 units.The fixed costs for the Assembly Division are assumed to be $15.00 per unit at 10,000 units.Compressor's costs per compressor are:

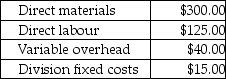

Assembly's costs per completed air conditioner are:

Assembly's costs per completed air conditioner are:

-If the Assembly Division sells 1,000 air conditioners at a price of $750.00 per air conditioner to customers, what is the company's operating income?

A) $200,500

B) $207,000

C) $194,000

D) $165,750

E) $230,500

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Management control systems motivate managers and other

Q87: Tech Clothing Ltd.manufactures t-shirts.The Athletic Division sells

Q89: Alsation Ltd.has two divisions:.The Machining Division prepares

Q90: Market-based transfer prices are generally accepted by

Q92: What are some of the factors, other

Q93: Provide a complete definition of a management

Q94: Use the information below to answer the

Q95: Answer the following question(s)using the information below:<br>Greenlawn

Q96: Use the information below to answer the

Q121: Additional factors that arise in multinational transfer