Essay

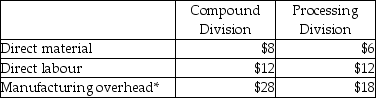

Payne Ltd.has two divisions.The Compound Division makes QZ54, an industrial compound, which is then transferred to the Processing Division.The Processing Division further processes the QZ54 and sells the final product to customers at $87/kg.Capacity in the Compound Division is 800,000 kg.QZ54 can be obtained on the external market at $50/kg Data regarding the costs per kilogram in each division are presented below:

*In the Compound Division the variable overhead is 80% of the total, and in Processing variable overhead represents 65% of the total.Fixed overhead rates are based on capacity of 800,000 kg.in each division.In addition to the manufacturing costs, the Compound Division would incur $2 per kilogram of selling costs which would be avoided on internal transfers.Similarly the Processing Division would avoid $3/kg.of ordering costs on internal purchases.Required:

*In the Compound Division the variable overhead is 80% of the total, and in Processing variable overhead represents 65% of the total.Fixed overhead rates are based on capacity of 800,000 kg.in each division.In addition to the manufacturing costs, the Compound Division would incur $2 per kilogram of selling costs which would be avoided on internal transfers.Similarly the Processing Division would avoid $3/kg.of ordering costs on internal purchases.Required:

a.Calculate the operating incomes for each division assuming 800,000 kg.of QZ54 are transferred and the company uses a market transfer price.

b.Calculate the operating incomes for each division assuming 800,000 kg.of QZ54 are transferred and the company uses a transfer pricing policy based on 125% of absorption manufacturing cost.

c.Comment on your calculations in a and b in terms of the respective division managers preferences.

d.Should the company transfer its 800,000 kg.assuming the Compound Division can sell all of its output on the external market?

Correct Answer:

Verified

a.

$48 ∗ 1.25 = $60

$48 ∗ 1.25 = $60

c.The Processing...

c.The Processing...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q27: Discuss the possible problems a corporation might

Q165: Market price is the only price that

Q167: A benefit of using a market-based transfer

Q168: Bradford Manufacturing Ltd.manufactures custom metal perforating and

Q169: All of the following are general methods

Q171: Answer the following question(s)using the information below.Easy

Q172: Use the information below to answer the

Q173: Use the information below to answer the

Q174: Centralia Components Ltd.manufactures cable assemblies used in

Q175: Answer the following question(s)using the information below:<br>Greenlawn