Essay

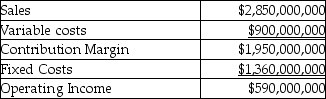

Clark Industries Ltd.manufactures monochromators that are used in a variety of applications.The Monochromator Division (M Division)sells its monochromators both internally and externally.It is operating at 80% of its 250,000 unit capacity and internal sales account for approximately 20% of its current sales volume.Internally the monochromators are transferred into the Aerospace Division (A Division)at a transfer price of $11,250 each.Variable production costs are the same for internal and external sales.The income statement for the M Division is presented below:

The A Division uses one component in the production of its final product that sells for $75,000/unit.Other variable costs in the A Division are 40% of sales.and fixed costs per unit at its current capacity of 40,000 units are $17,250.The Aerospace Division is operating at its full capacity of 40,000 units and is evaluating whether it should invest to increase capacity.The investment would cost $900,000,000 and would have a useful life of 3 years.The equipment could be sold for $800,000 at the end of its useful life.For tax purposes it would be sold on January 1 of year 4.The machine would be used to manufacture a variation of its current product with the same transfer price.This new product would sell for $68,000 per unit.The variable cost ratio will be 45% of the selling price.The additional capacity of the new machine would be 14,000 units.It would qualify for a 30% CCA rate and the company would continue to have assets in the pool.Required:

The A Division uses one component in the production of its final product that sells for $75,000/unit.Other variable costs in the A Division are 40% of sales.and fixed costs per unit at its current capacity of 40,000 units are $17,250.The Aerospace Division is operating at its full capacity of 40,000 units and is evaluating whether it should invest to increase capacity.The investment would cost $900,000,000 and would have a useful life of 3 years.The equipment could be sold for $800,000 at the end of its useful life.For tax purposes it would be sold on January 1 of year 4.The machine would be used to manufacture a variation of its current product with the same transfer price.This new product would sell for $68,000 per unit.The variable cost ratio will be 45% of the selling price.The additional capacity of the new machine would be 14,000 units.It would qualify for a 30% CCA rate and the company would continue to have assets in the pool.Required:

a.Evaluate the current transfer pricing policy from the standpoint of each division manager as well as the company as a whole.

b.Using net present value (NPV)analysis, would the A Division manager want to invest in the new equipment if the required rate of return is 12% and the tax rate is 25%?

c.If the investment is evaluated from a corporate perspective using NPV analysis and the 12% discount rate, does the decision change? Explain.

Correct Answer:

Verified

a.The M Division currently charges the A...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q92: What are some of the factors, other

Q93: Provide a complete definition of a management

Q94: Use the information below to answer the

Q95: Answer the following question(s)using the information below:<br>Greenlawn

Q96: Use the information below to answer the

Q98: Briefly explain each of the three general

Q99: Sportswear Ltd.manufactures socks.The Athletic Division sells its

Q100: Hendricks Ltd.of Calgary manufactures and sells computers.The

Q101: For each of the following activities, characteristics,

Q102: A Canadian company has subsidiaries in France,