Multiple Choice

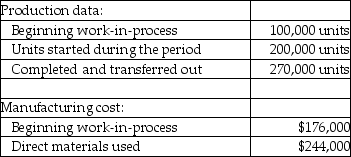

Use the information below to answer the following question(s) .Canadian Oil Company manufactures cooking oils.All direct materials are added at the beginning of the production process.The company currently uses the FIFO method.Data for the month of July is listed below.

-Unit costs of the weighted-average and FIFO methods will differ significantly when

A) direct materials or conversion costs per unit vary little from period to period.

B) physical inventory levels of work-in-process are small in relation to the number of units transferred out.

C) direct materials or conversion cost per unit vary greatly and physical inventory levels of work-in-process are large relative to the number of units transferred out.

D) conversion costs per unit vary greatly and physical inventory levels of work-in-process are small relative to the number of units transferred out.

E) direct materials or conversion costs per unit are similar and physical inventory of work-in-process are small relative to the number of units transferred in.

Correct Answer:

Verified

Correct Answer:

Verified

Q73: Use the information below to answer the

Q74: Use the information below to answer the

Q75: A key feature in process costing is

Q77: An operation costing system would be applicable

Q79: Which of the following is false concerning

Q80: Smithers Ltd.uses the FIFO method for its

Q81: Transferred-in costs are an allocated indirect cost

Q82: It is possible to design a hybrid

Q83: Calendar Time Company prints calendars.All direct materials

Q127: What is the difference between a weighted-average