Essay

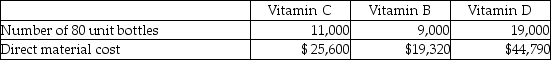

Vita-Heath Company manufactures three different types of vitamins: vitamin C, vitamin B, and vitamin D.The company uses four operations to manufacture the vitamins: mixing, tabletting, encapsulating, and bottling.Vitamins C and B are produced in tablet form (in the tabletting department)and vitamin D is produced in capsule form (in the encapsulating department).Each bottle contains 80 vitamins, regardless of the product.Conversion costs are applied based on the number of bottles in the tabletting and encapsulating departments.Conversion costs are applied based on direct labour hours in the mixing department.It takes two minutes to mix ingredients for a 80-unit bottle for each product.Conversion costs are applied based on machine hours in the bottling department.It takes one-tenth of a minute of machine time to fill a 80-unit bottle, regardless of product.Vita-Health Company uses operation costing.The company is planning to complete one batch of each type of vitamin in March.The budgeted number of bottles and expected direct material cost for each type of vitamin is as follows:

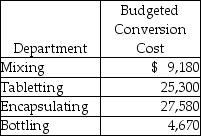

The budgeted conversion costs for March are as follows:

The budgeted conversion costs for March are as follows:

Required:

Required:

1.Calculate the conversion cost rates for each department.2.Calculate the budgeted cost of goods manufactured for vitamin C, vitamin B, and vitamin D for the month of March.3.Calculate the cost per 80-unit bottle for each type of vitamin for the month of July.

Correct Answer:

Verified

1.Calculate the conversion rat...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q9: Process-costing journal entries and job-costing journal entries

Q21: Use the information below to answer the

Q23: Use the information below to answer the

Q24: Four Seasons Company makes snow blowers.Materials are

Q25: The first-in, first-out process-costing method assumes that

Q28: Answer the following questions using the information

Q29: Use the information below to answer the

Q30: The first-in, first-out method computes unit costs

Q31: An operation-costing system is a hybrid costing

Q118: The weighted average method of process costing