Multiple Choice

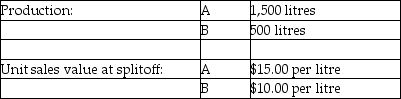

Use the information below to answer the following question(s) .Beverage Drink Company processes direct materials up to the splitoff point, where two products, A and B, are obtained.The following information was collected for the month of July:

Direct materials processed: 2,500 litres (with 20 percent shrinkage)

Cost of purchasing 2,500 litres of direct materials and processing it up to the splitoff point to yield a total of 2,000 litres of good products was $4,500.There were no inventory balances of A and B.Product A may be processed further to yield 1,375 litres of Product Z5 for an additional processing cost of $150.Product Z5 is sold for $25.00 per litre.There was no beginning inventory and ending inventory was 125 litres.Product B may be processed further to yield 375 litres of Product W3 for an additional processing cost of $275.Product W3 is sold for $30.00 per litre.There was no beginning inventory and ending inventory was 25 litres.

Cost of purchasing 2,500 litres of direct materials and processing it up to the splitoff point to yield a total of 2,000 litres of good products was $4,500.There were no inventory balances of A and B.Product A may be processed further to yield 1,375 litres of Product Z5 for an additional processing cost of $150.Product Z5 is sold for $25.00 per litre.There was no beginning inventory and ending inventory was 125 litres.Product B may be processed further to yield 375 litres of Product W3 for an additional processing cost of $275.Product W3 is sold for $30.00 per litre.There was no beginning inventory and ending inventory was 25 litres.

-What is Product Z5's and Product W3's respective production cost per unit, assuming the company allocates joint costs on the basis of net realizable value?

A) $2.05 and $3.88

B) $2.42 and $2.78

C) $2.49 and $2.88

D) $2.60 and $3.61

E) $2.86 and $3.68

Correct Answer:

Verified

Correct Answer:

Verified

Q7: What are the four methods of allocating

Q182: Answer the following questions using the information

Q183: Match each of the following costs with

Q184: Use the information below to answer the

Q185: Use the information below to answer the

Q186: Use the information below to answer the

Q188: Red Sauce Canning Company processes tomatoes into

Q189: Match each of the following costs with

Q190: Use the information below to answer the

Q192: A business which enters into a contract