Multiple Choice

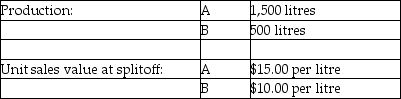

Use the information below to answer the following question(s) .Beverage Drink Company processes direct materials up to the splitoff point, where two products, A and B, are obtained.The following information was collected for the month of July:

Direct materials processed: 2,500 litres (with 20 percent shrinkage)

Cost of purchasing 2,500 litres of direct materials and processing it up to the splitoff point to yield a total of 2,000 litres of good products was $4,500.There were no inventory balances of A and B.Product A may be processed further to yield 1,375 litres of Product Z5 for an additional processing cost of $150.Product Z5 is sold for $25.00 per litre.There was no beginning inventory and ending inventory was 125 litres.Product B may be processed further to yield 375 litres of Product W3 for an additional processing cost of $275.Product W3 is sold for $30.00 per litre.There was no beginning inventory and ending inventory was 25 litres.

Cost of purchasing 2,500 litres of direct materials and processing it up to the splitoff point to yield a total of 2,000 litres of good products was $4,500.There were no inventory balances of A and B.Product A may be processed further to yield 1,375 litres of Product Z5 for an additional processing cost of $150.Product Z5 is sold for $25.00 per litre.There was no beginning inventory and ending inventory was 125 litres.Product B may be processed further to yield 375 litres of Product W3 for an additional processing cost of $275.Product W3 is sold for $30.00 per litre.There was no beginning inventory and ending inventory was 25 litres.

-Which of the following joint cost allocation methods calculates expected profits before any costs are allocated?

A) sales value at splitoff method

B) physical measure method

C) expected profits method

D) estimated net realizable method

E) constant gross margin percentage of NRV method

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Santos Corporation processes a single material into

Q9: Which of the following is NOT a

Q10: Answer the following question(s)using the information below.The

Q11: BC Lumber processes timber into four products.During

Q12: The net realizable value method can be

Q14: Trundle Ltd.produces two main products, J and

Q15: Which of the following statements is TRUE

Q16: CSI Chemical, Inc.processes pine rosin into three

Q17: What type of cost is the result

Q18: What are separable costs?