Multiple Choice

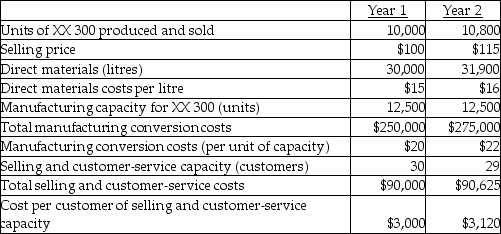

Use the information below to answer the following question(s) .Following a strategy of product differentiation, Barry Company makes an XX 300.Barry Company presents the following data for the years 1 and 2.  Barry Company produces no defective units but it wants to reduce direct materials usage per unit of XX 300 in year 2.Manufacturing conversion costs in each year depend on production capacity defined in terms of XX 300 units that can be produced.Selling and customer-service costs depend on the number of customers that the customer and service functions are designed to support.Neither conversion costs or customer-service costs are affected by changes in actual volume.Barry Company has 23 customers in year 1 and 25 customers in year 2.The industry market size for high-end appliances increased 5% from year 1 to year 2.

Barry Company produces no defective units but it wants to reduce direct materials usage per unit of XX 300 in year 2.Manufacturing conversion costs in each year depend on production capacity defined in terms of XX 300 units that can be produced.Selling and customer-service costs depend on the number of customers that the customer and service functions are designed to support.Neither conversion costs or customer-service costs are affected by changes in actual volume.Barry Company has 23 customers in year 1 and 25 customers in year 2.The industry market size for high-end appliances increased 5% from year 1 to year 2.

-What is the Barry Company's productivity component of change in operating income?

A) $31,620 favourable

B) $11,120 favourable

C) $11,120 unfavourable

D) $33,520 favourable

E) $33,520 unfavourable

Correct Answer:

Verified

Correct Answer:

Verified

Q62: Productivity measures the relationship between actual inputs

Q127: Use the information below to answer the

Q128: Downsizing is also called rightsizing.

Q129: What is the direct manufacturing labour partial

Q131: Buck Corporation plans to grow by offering

Q134: Learning and growth perspective identifies the capabilities

Q135: According to Michael Porter which of the

Q136: Bosely Corporation is reviewing its business strategy.The

Q137: Employee satisfaction is a measure of the

Q147: Total factor productivity (TFP) is easy to