Essay

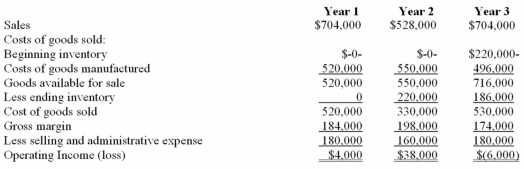

The Hadfield Company manufactures and sells a unique electronic part.The company's plant is highly automated with low variable and high fixed manufacturing costs.Operating results on an absorption costing basis for the first three years of activity were as follows:

Additional information about the company is as follows:

-Variable manufacturing costs (direct labour,direct materials,and variable manufacturing overhead)total $3 per unit,and fixed manufacturing overhead costs total $400,000.

-Fixed manufacturing costs are applied to units of product on the basis of the number of units produced each year (i.e. ,a new fixed overhead rate is computed each year).

-The company uses a FIFO inventory flow assumption.

-Variable selling and administrative expenses are $2 per unit sold.Fixed selling and administrative expenses total $100,000.

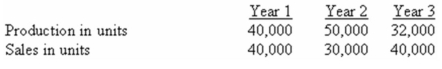

-Production and sales information for the three years is as follows:

Required:

a)Compute operating income for each year under the variable costing approach.

b)Prepare a reconciliation from your Operating Income (loss)under variable costing to Absorption Costing operating income for year 3.

c)Referring to the absorption costing income statements above,explain why operating income was higher in Year 2 than in Year 1 under absorption costing,in light of the fact that fewer units were sold in Year 2 than in Year 1.

d)Referring again to the absorption costing income statements,explain why the company suffered an operating loss in Year 3 but reported a positive operating income in Year 1,although the same number of units was sold in each year.

e)If the company had used just-in-time (JIT)during Year 2 and Year 3 and produced only what could be sold,what would have been the company's operating income (loss)for each year under absorption costing.

Correct Answer:

Verified

c)Production increased sharply in Y...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

c)Production increased sharply in Y...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Hatfield Company, which has only

Q7: Peaceman Company, which has only one

Q17: The following data pertain to one

Q26: Last year, Walsh Company manufactured

Q40: Since variable costing emphasizes costs by behaviour,it

Q53: Although variable costing is NOT permitted for

Q58: Qabar Company,which has only one product,has provided

Q91: Y Company reported operating income for Year

Q104: Farron Company, which has only one

Q133: Absorption costing operating income is closer to