Essay

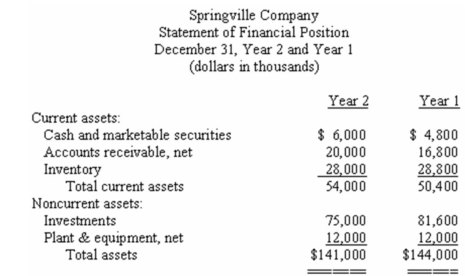

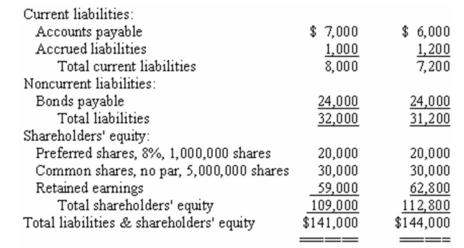

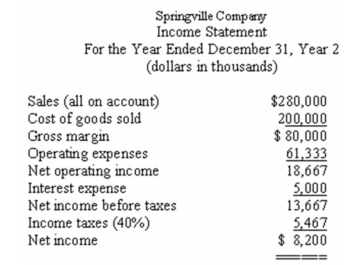

Comparative financial statements for Springville Company for the last two years appear below.The market price of Springville's common shares was $25 per share on December 31,Year 2.During Year 2,dividends of $2,000,000 were paid to preferred shareholders and $10,000,000 to common shareholders.

Required:

Calculate the following for Year 2:

a)Dividend payout ratio.

b)Dividend yield ratio.

c)Price-earnings ratio.

d)Accounts receivable turnover.

e)Inventory turnover.

f)Return on total assets.

g)Return on common shareholders' equity.

h)Was financial leverage positive or negative for the year? Explain.

Correct Answer:

Verified

a)Dividend payout ratio = Dividends per ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q15: Financial statements for Orantes Company

Q27: Financial statements for Narlock Company appear

Q39: Financial statements for Larned Company

Q47: <span class="ql-formula" data-value="\begin{array}{l}\text { The Dawson Corporation

Q61: The times interest earned ratio of McHugh

Q75: Oratz Company's average sale period (turnover in

Q82: Krakov Company has total assets of $170,000

Q95: Lisa Inc.'s balance sheet appears below:<br><img

Q194: Which one of the following would increase

Q195: Which of the following is true regarding