Essay

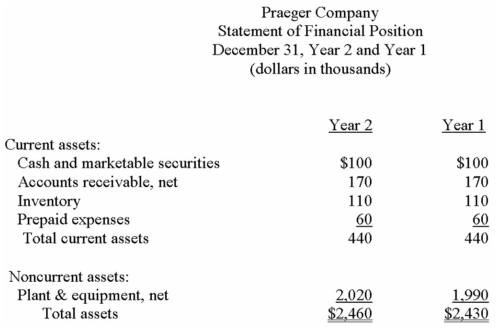

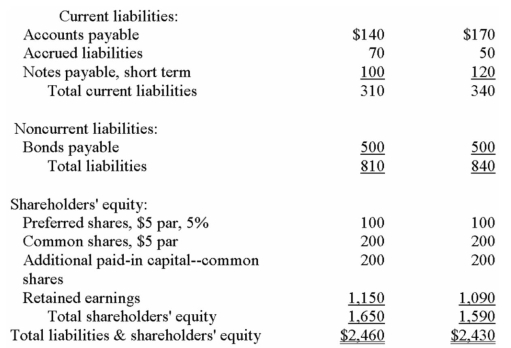

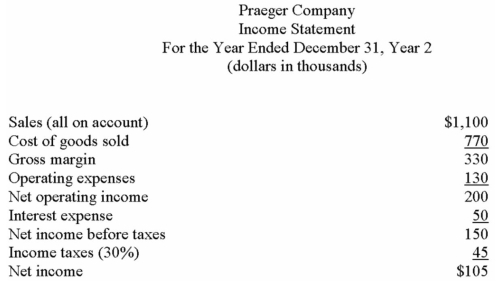

Financial statements for Praeger Company appear below:

Dividends during Year 2 totalled $45,000,of which $10,000 were preferred dividends.The market price of a common share on December 31,Year 2 was $30.

The preferred shares are convertible to common shares on the basis of 2 common shares for each preferred share.

Required:

Calculate the following for Year 2:

a)Basic earnings per common share.

b)Fully diluted earnings per common share.

c)Price-earnings ratio (use basic earnings per share).

d)Dividend payout ratio (use basic earnings per share).

e)Dividend yield ratio.

f)Return on total assets.

g)Return on common shareholders' equity.

h)Book value per share.

i)Working capital.

j)Current ratio.

k)Acid-test (quick)ratio.

l. )Accounts receivable turnover.

m)Average collection period (age of receivables).

n)Inventory turnover.

o)Average sale period (turnover in days).

p)Times interest earned.

q)Debt-to-equity ratio.

Correct Answer:

Verified

a)Basic earnings per share = (Net income...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q34: Financial statements for March Company appear

Q66: Dratif Company's working capital is $33,000,and its

Q78: Earnings per common share will immediately increase

Q79: Financial statements for Larosa Company

Q80: <span class="ql-formula" data-value="\begin{array}{l}\text { Selected data for

Q108: Harton Company,a retailer,had cost of goods sold

Q134: Financial statements for Marcell Company

Q137: Rahner Company has a current ratio of

Q140: Financial statements for Raridan Company appear below:

Q143: The following data have been taken from