Essay

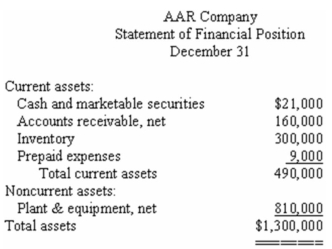

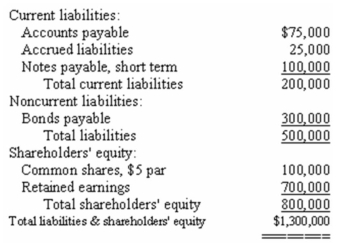

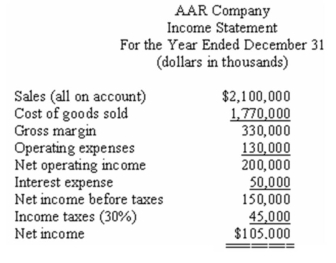

Financial statements for AAR Company appear below:

AAR Company paid dividends of $3.15 per share during the year.The market price of the company's common shares at December 31 was $63 per share.Total assets at the beginning of the year were $1,100,000,and total shareholders' equity was $725,000.The balance of accounts receivable at the beginning of the year was $150,000.The balance in inventory at the beginning of the year was $250,000.

Required:

Calculate the following:

a)Current ratio.

b)Acid-test (quick)ratio.

c)Average collection period (age of receivables).

d)Inventory turnover.

e)Times interest earned.

f)Debt-to-equity ratio.

g)Dividend payout ratio.

h)Price-earnings ratio.

i)Return on total assets.

j)Return on common shareholders' equity.

k)Was financial leverage positive or negative for the year? Explain.

Correct Answer:

Verified

a)Current ratio = Current assets/Current...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q44: The following account balances have been provided

Q45: Information concerning the common shares of Morris

Q46: Cameron Company had 50,000 common shares issued

Q53: The net accounts receivable for Andante Company

Q73: The gross margin percentageis most likely to

Q84: Financial statements for Oratz Company

Q88: Irally Company,a retailer,had cost of goods sold

Q114: Financial statements for Oratz Company

Q138: Selected financial data for Barnstable

Q160: McGraw Electronics showed Bonds Payable of $7,500,000