Essay

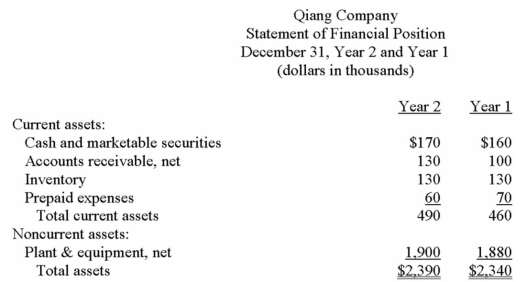

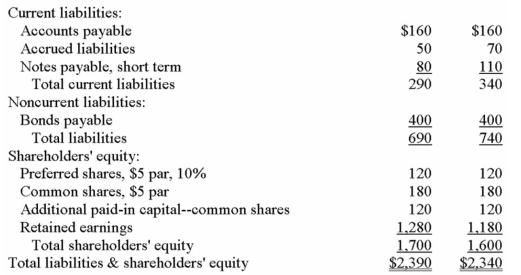

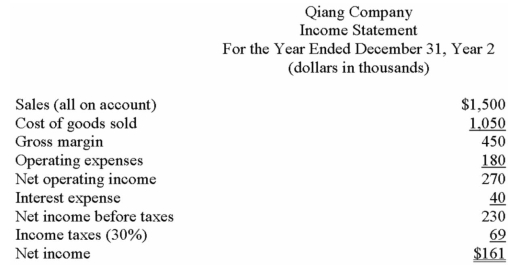

Financial statements for Qiang Company appear below:

Total dividends paid during Year 2 were $61,000,of which $12,000 were for preferred shares.The market price of a common share on December 31,Year 2 was $50.

The preferred shares are convertible to common shares on the basis of four common shares for each preferred share.

Required:

Calculate the following for Year 2:

a)Basic earnings per common share.

b)Fully diluted earnings per common share.

c)Price-earnings ratio (use basic earnings per share).

d)Dividend yield ratio.

e)Return on total assets.

f)Return on common shareholders' equity.

g)Book value per share.

Correct Answer:

Verified

a)Basic earnings per share = (Net Income...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q9: To put the working capital figure into

Q70: Eral Company has $17,000 in cash,$3,000 in

Q72: Crasler Company's net income last year was

Q91: The price-earnings ratio is calculated by dividing

Q96: Financial statements for Qualle Company appear below:

Q112: Financial statements for March Company appear

Q147: Arquandt Company's net income last year was

Q164: <span class="ql-formula" data-value="\begin{array}{l}\text { Selected data for

Q166: How is horizontalanalysis of financial statements accomplished?<br>A)

Q181: Common-size statementsare particularly useful when comparing data