Essay

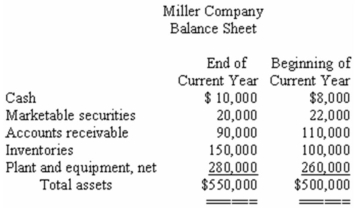

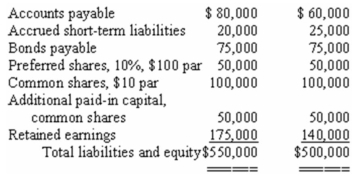

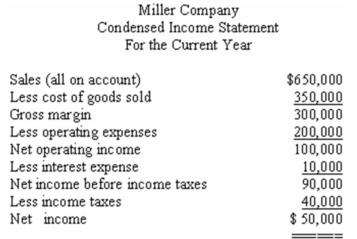

Condensed financial statements of Miller Company at the beginning and at the end of the current year are given below:

The company paid total dividends of $15,000 during the year,of which $5,000 were to preferred shareholders.The market price of a common share at the end of the year was $30.

Required:

On the basis of the information given above,fill in the blanks with the appropriate figures.

Example: The current ratio at the end of the current year would be computed by dividing $270,000 by $100,000.

a)The acid-test (quick)ratio at the end of the current year would be computed by dividing _______________ by ________________.

b)The inventory turnover for the year would be computed by dividing _______________ by ________________.

c)The debt-to-equity ratio at the end of the current year would be computed by dividing _______________ by ________________.

d)The earnings per common share would be computed by dividing _______________ by ________________.

e)The accounts receivable turnover for the year would be computed by dividing _______________ by ________________.

f)The times interest earned for the year would be computed by dividing _______________ by ________________.

g)The return on common shareholders' equity for the year would be computed by dividing _______________ by ________________.

h)The dividend yield would be computed by dividing _______________ by ________________.

Correct Answer:

Verified

a)$120,000;$100,000.

b)$350,00...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

b)$350,00...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q66: Dratif Company's working capital is $33,000,and its

Q99: Financial statements for Oratz Company

Q108: Harton Company,a retailer,had cost of goods sold

Q132: The market price of XYZ Company's common

Q135: Financial statements for Marcell Company

Q137: Rahner Company has a current ratio of

Q154: Grapp Company had $130,000 in sales on

Q188: If a company converts a short-termnote payable

Q191: Financial statements for Oratz Company

Q194: <span class="ql-formula" data-value="\begin{array}{l}\text { At December 31,