Essay

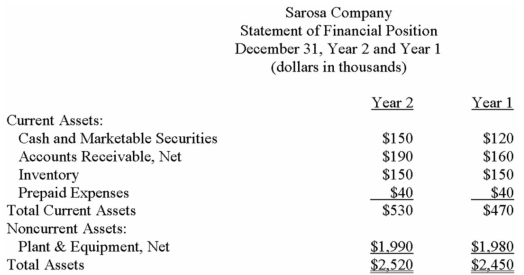

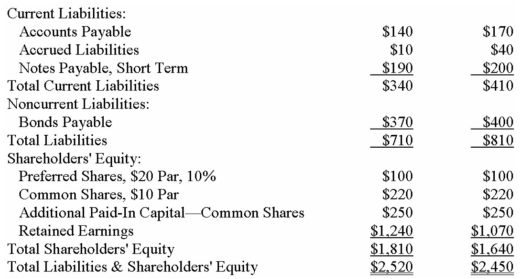

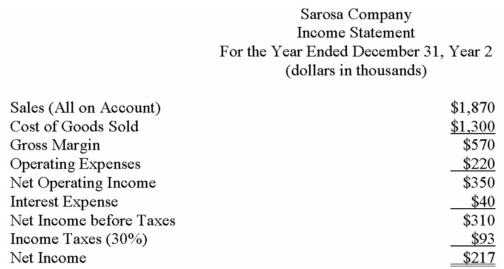

Financial statements for Sarosa Company appear below:

Required:

a)Calculate Sarosa Company's return on total assets for Year 2.

b)Calculate Sarosa Company's return on common shareholders' equity for Year 2.

c)Financial leverage was positive for Year 2.Why?

d)Assume all current liabilities are interest free and that the interest expense of $40 is for the bonds payable.

(i)Calculate the dollar amount of the financial leverage (in $1,000)

(ii)Allocate the dollar amount of the financial leverage to the following sources of financing: Preferred Shares,Bonds Payable,and Current Liabilities (rounded to the nearest $1,000)

Correct Answer:

Verified

Correct Answer:

Verified

Q5: What will happen to the ratios below

Q9: Orantes Company's average sale period (turnover in

Q11: Financial statements for Rarity Company appear below:

Q36: If a company's bonds bear an interest

Q48: If the market value of a common

Q83: Financial statements for Orange Company appear

Q107: The total assets of the Philbin Company

Q127: If a firm has a high current

Q162: Financial statements for Larned Company

Q178: <span class="ql-formula" data-value="\begin{array}{l}\text { Selected data for