Multiple Choice

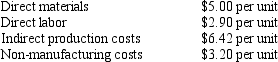

Clark Manufacturing makes blank CDs; it is a very competitive market and the company follows a target pricing strategy. Currently the market price for a unit of product (one unit equals a package of 100 CDs) is $18.00. Clark's production costs are shown below:  Clark uses activity-based costing for its indirect production costs and provides the following information about this particular product:

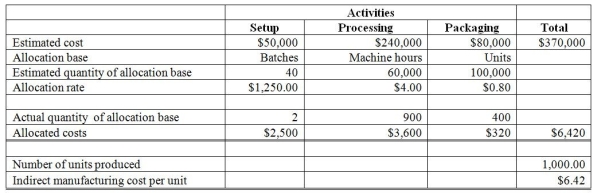

Clark uses activity-based costing for its indirect production costs and provides the following information about this particular product: The company's objective is to earn 5% profit on the sales price of the product. Based on the above data, how much cost reduction does the company need to achieve its objective?

The company's objective is to earn 5% profit on the sales price of the product. Based on the above data, how much cost reduction does the company need to achieve its objective?

A) $0.90

B) $0.34

C) $0.42

D) $0.62

Correct Answer:

Verified

Correct Answer:

Verified

Q15: Internal failure costs occur when the company

Q33: The main difference between activity-based costing and

Q39: The cost to improve equipment and processes

Q48: Just-in-time production systems are organized into independent

Q72: In a just-in-time costing system, the entry

Q77: The lost profits from losing customers would

Q134: Brannon Company manufactures ceiling fans and uses

Q139: Formosa Steel Products makes steel building materials

Q156: Bakersfield Manufacturing produces agricultural tools including a

Q157: Activity-based management refers to using activity-based cost