Multiple Choice

On July 1, 2013, Avery Services issued a 4% long-term note payable for $10,000. It is payable over a 5-year term in $2,000 principal installments on July 1 of each year. Which of the following entries needs to be made at year-end 2013 to accrue interest?

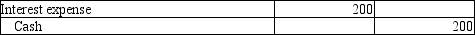

A)

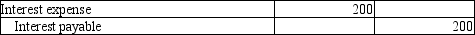

B)

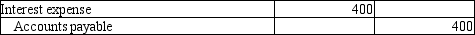

C)

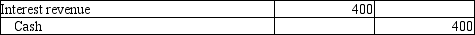

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q57: Please refer to the following list of

Q60: On January 1, 2014, Partridge Company issued

Q61: McDonald Sales prepared a bond issue of

Q63: On January 2,2014,Mahoney Sales issued $10,000 in

Q77: A bond payable is similar to which

Q92: On December 31,2013,Peterson Sales has a bonds

Q105: Using the present value tables,please compute the

Q109: The main reason companies retire bonds prior

Q135: On January 1,2013,Davie Services issued $20,000 of

Q137: If the difference between the effective-interest method