Multiple Choice

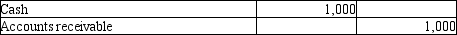

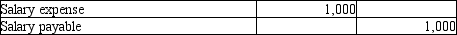

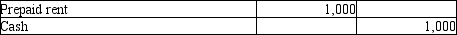

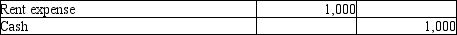

Which of the following entries would be recorded if a company is using the cash-basis method of accounting?

A)

B)

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q14: Hank's Tax Planning Service has the following

Q15: Chelsea Services Company pays its staff their

Q18: Below is the adjusted trial balance for

Q20: On April 1, Balsa Company purchased $800

Q25: Robert Rogers,CPA performed accounting services for a

Q52: What type of account is Unearned revenue

Q85: Employees of Robert Rogers,CPA worked during the

Q91: Pattie's Event Planning Service collects the fees

Q92: ABC Company signed a one-year $12,000 note

Q128: Financial statements are prepared from a(n):<br>A) general