Multiple Choice

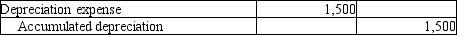

On December 31, 2012, the adjusting entry for depreciation was made incorrectly. The following entry was made erroneously:  The correct amount of depreciation should have been $5,100. Consider the effects of this error on the income statement, and identify which of the following statements is TRUE.

The correct amount of depreciation should have been $5,100. Consider the effects of this error on the income statement, and identify which of the following statements is TRUE.

A) Net income is overstated by $3,600.

B) Net income is understated by $3,600.

C) Net income is understated y $1,500.

D) Net income is not affected by this error.

Correct Answer:

Verified

Correct Answer:

Verified

Q13: Hank's Tax Planning Service bought communications equipment

Q72: Which of the following accounts would NOT

Q83: A business pays its insurance premium of

Q107: Hank's Tax Planning Service bought computer equipment

Q115: Robert Rogers,CPA owns a computer used for

Q125: Unearned revenue is revenue that:<br>A) will be

Q127: The accountant for Hobson Electrical Repair Company

Q129: Prepare a balance sheet from the adjusted

Q135: Which of the following entries would be

Q156: In the case of a prepaid expense,the