Multiple Choice

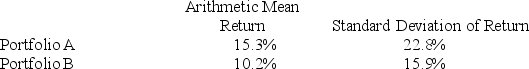

The table below gives statistics relating to a hypothetical 10-year record of two portfolios. Assume other statistics relating to these portfolios are the same and the risk-free rate is 3.5%.  Using the coefficient of variation and the Sharpe ratio, the fund that is preferred in terms of relative risk and return per unit of risk is ________.

Using the coefficient of variation and the Sharpe ratio, the fund that is preferred in terms of relative risk and return per unit of risk is ________.

A) Portfolio A because it has a higher coefficient of variation and a lower Sharpe ratio

B) Portfolio A because it has a lower coefficient of variation and a higher Sharpe ratio

C) Portfolio B because it has a higher coefficient of variation and a lower Sharpe ratio

D) Portfolio B because it has a lower coefficient of variation and a higher Sharper ratio

Correct Answer:

Verified

Correct Answer:

Verified

Q64: The standard deviation is the positive square

Q125: The coefficient of variation is best described

Q126: Calculate the interquartile range from the following

Q127: What is(are) characteristic(s) of the geometric mean?<br>A)

Q128: Calculate the mean, median, and mode of

Q129: The following data represent the number of

Q131: Amounts spent by a sample of 200

Q132: Which of the following is true when

Q133: Which of the following capabilities does Analysis

Q134: The following is a list of the