Multiple Choice

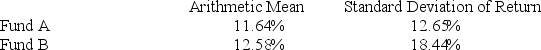

The following table summarizes selected statistics for two portfolios for a 10-year period. Assume that the risk-free rate is 4% over this period.  As measured by the Sharpe ratio, the fund with the superior risk-adjusted performance during this period is ________.

As measured by the Sharpe ratio, the fund with the superior risk-adjusted performance during this period is ________.

A) Fund A because it has a lower positive Sharpe ratio than Fund B

B) Fund B because it has a lower positive Sharpe ratio than Fund A

C) Fund A because it has a higher positive Sharpe ratio than Fund B

D) Fund B because it has a higher positive Sharpe ratio than Fund A

Correct Answer:

Verified

Correct Answer:

Verified

Q24: The following is a list of average

Q25: A bowler's scores for a sample of

Q26: A surfer visited his favorite beach 50

Q27: A luxury apartment complex in South Beach

Q28: The following table shows the annual returns

Q30: Which of the following relationships can be

Q31: John lives in Los Angeles and hates

Q32: Which are characteristic(s) of the coefficient of

Q33: Professors at a local university earn an

Q34: The annual returns (in percent) for a