Multiple Choice

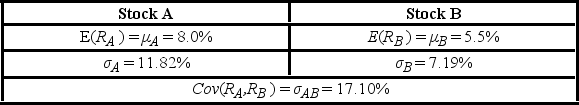

An investor has a $100,000 portfolio of which $75,000 has been invested in Stock A and the remainder in Stock B. Other characteristics of the portfolio are shown in the accompanying table.  The expected return of the portfolio is ________.

The expected return of the portfolio is ________.

A) 6.30%

B) 6.75%

C) 7.38%

D) 13.50%

Correct Answer:

Verified

Correct Answer:

Verified

Q1: A discrete random variable X may assume

Q3: A probability distribution of a continuous random

Q4: Sam is a trucker and believes that

Q5: Given the information in the accompanying table,

Q6: An Excel's function _ is used for

Q7: According to geologists, the San Francisco Bay

Q8: Consider the following cumulative distribution function for

Q9: Forty-four percent of consumers with credit cards

Q10: The relationship between the variance and the

Q11: The hypergeometric probability distribution is appropriate in