Short Answer

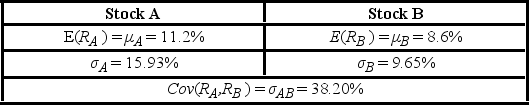

An investor has a $120,000 portfolio of which $50,000 has been invested in Stock A and the remainder in Stock B. Other characteristics of the portfolio are as follows:  a. Calculate the correlation coefficient.

a. Calculate the correlation coefficient.

B) Calculate the expected return of the portfolio.

C) Calculate the standard deviation of the portfolio.

Correct Answer:

Verified

a. 0.2485

...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q128: The following table shows the number of

Q129: A cumulative probability distribution of a random

Q130: According to a study by the Centers

Q131: Testing whether the computer is infected or

Q132: What are the two key properties of

Q134: A risk-neutral consumer ignores risk and makes

Q135: The expected value of a random variable

Q136: It is known that 10% of the

Q137: A plane taking off from an airport

Q138: Consider the following discrete probability distribution. <img