Multiple Choice

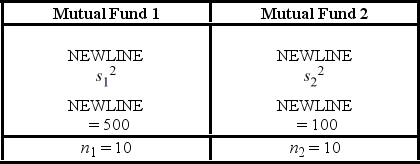

A financial analyst examines the performance of two mutual funds and claims that the variances of the annual returns for the bond funds differ. To support his claim, he collects data on the annual returns (in percent) for the years 2001 through 2010. The analyst assumes that the annual returns for the two emerging market bond funds are normally distributed. Use the following summary statistics.  The competing hypotheses are Η0:

The competing hypotheses are Η0:  /

/  = 1, ΗA:

= 1, ΗA:  /

/  ≠ 1, At α = 0.10, is the analyst's claim supported by the data?

≠ 1, At α = 0.10, is the analyst's claim supported by the data?

A) No, the p-value < α = 0.10.

B) Yes, the p-value > α = 0.10.

C) No, the p-value > α = 0.10.

D) Yes, the p-value < α = 0.10.

Correct Answer:

Verified

Correct Answer:

Verified

Q98: The manager of a video library would

Q99: Find the value x for which<br>A) P(

Q100: Amie Jackson, a manager at Sigma travel

Q101: A random sample of 10 homes sold

Q102: As the df grow larger, the <img

Q104: The F distribution depends on _ degrees

Q105: A supermarket has just added a new

Q106: Which of the following Excel functions is

Q107: Using the critical value approach, conduct the

Q108: For a test about the ratio of