Essay

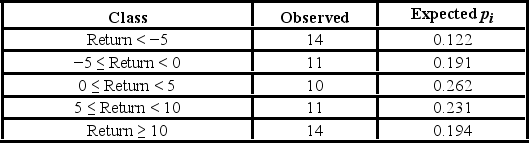

The following table shows the observed frequencies of the quarterly returns for a sample of 60 hedge funds. The table also contains the hypothesized proportions of each class assuming the quarterly returns have a normal distribution. The sample mean and standard deviation are 3.6% and 7.4% respectively.  a. Set up the competing hypotheses for the goodness-of-fit test of normality for the quarterly returns.

a. Set up the competing hypotheses for the goodness-of-fit test of normality for the quarterly returns.

B) Calculate the value of the test statistic and determine the degrees of freedom.

C) Compute the p-value. Does the evidence suggest that the quarterly returns do not have a normal distribution at the 10% significance level?

Correct Answer:

Verified

a. H0: Quarterly returns follow a normal ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q84: If the null hypothesis is rejected by

Q85: The heights (in cm) for a random

Q86: The following table shows the distribution of

Q87: The calculation of the Jarque-Bera test statistic

Q88: A fund manager wants to know if

Q90: A manufacturer of flash drives for data

Q91: A university has six colleges and takes

Q92: For the goodness-of-fit test, the expected category

Q93: A researcher wants to verify his belief

Q94: The following table shows the distribution of