Short Answer

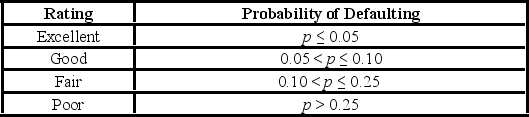

A bank manager is interested in assigning a rating to the holders of credit cards issued by her bank. The rating is based on the probability of defaulting on credit cards and is as follows.  To estimate this probability, she decided to use the logit model,

To estimate this probability, she decided to use the logit model,

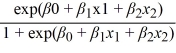

P =  , where

, where

y = a binary response variable which is 1 if the credit card is in default and 0 otherwise

x1 = the ratio of the credit card balance to the credit card limit (in %)

x2 = the ratio of the total debt to the annual income (in %)

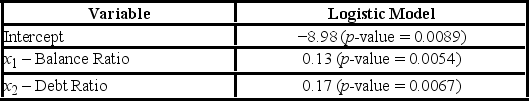

The following output is obtained.  Note: The p-values of the corresponding tests are shown in parentheses below the estimated coefficients.

Note: The p-values of the corresponding tests are shown in parentheses below the estimated coefficients.

Assuming the debt ratio 30%, compute the increase in the probability of defaulting when the balance ratio goes up from 5% to 15%.

Correct Answer:

Verified

Correct Answer:

Verified

Q54: According to the Center for Disease Control

Q55: Consider the following regression model: Humidity =

Q56: Consider the regression model y = β<sub>0

Q57: An over-the-counter drug manufacturer wants to examine

Q58: A researcher wants to examine how the

Q60: A bank manager is interested in assigning

Q61: In a model y = β<sub>0</sub> +

Q62: An over-the-counter drug manufacturer wants to examine

Q63: A researcher wants to examine how the

Q64: The number of dummy variables representing a