Short Answer

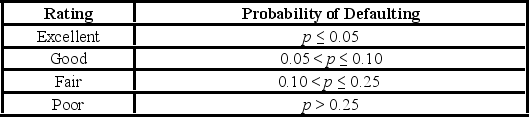

A bank manager is interested in assigning a rating to the holders of credit cards issued by her bank. The rating is based on the probability of defaulting on credit cards and is as follows.  To estimate this probability, she decided to use the logit model,

To estimate this probability, she decided to use the logit model,

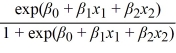

P =  , where

, where

y = a binary response variable which is 1 if the credit card is in default and 0 otherwise

x1 = the ratio of the credit card balance to the credit card limit (in %)

x2 = the ratio of the total debt to the annual income (in %)

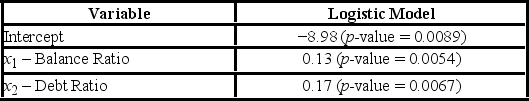

The following output is obtained.  Note: The p-values of the corresponding tests are shown in parentheses below the estimated coefficients.

Note: The p-values of the corresponding tests are shown in parentheses below the estimated coefficients.

(Using Excel or R) Suppose that only applicants with excellent and good ratings are qualified for a loan. Assume that the balance ratio, x1, of those who apply is normally distributed with μ1 = 18% and σ2 = 6%, while their debt ratio, x2, is normally distributed with μ2 = 30% and σ2 = 8%. Assume also that x1 and x2 are independent. Simulate 1,000 applications to estimate the percent of those that are qualified for a loan.

Correct Answer:

Verified

Correct Answer:

Verified

Q29: An over-the-counter drug manufacturer wants to examine

Q30: For the model y = β<sub>0</sub> +

Q31: Which of the following predictions cannot be

Q32: In the model y = β<sub>0</sub> +

Q33: A researcher wants to examine how the

Q35: To examine the differences between salaries of

Q36: To examine the differences between salaries of

Q37: Like any other university, Seton Hall University

Q38: Which of the following regression models does

Q39: To examine the differences between salaries of