Essay

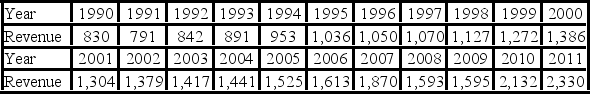

The following table shows the annual revenues (in millions of dollars) of a pharmaceutical company over the period 1990-2011.  The autoregressive models of order 1 and 2, yt = β0 + β1yt - 1 + εt, and yt = β0 + β1yt - 1 + β2yt - 2 + εt, were applied on the time series to make revenue forecasts. The relevant parts of Excel regression outputs are given below.

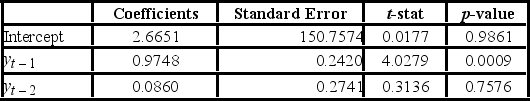

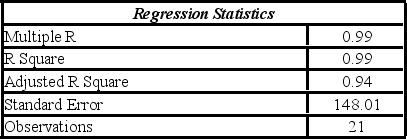

The autoregressive models of order 1 and 2, yt = β0 + β1yt - 1 + εt, and yt = β0 + β1yt - 1 + β2yt - 2 + εt, were applied on the time series to make revenue forecasts. The relevant parts of Excel regression outputs are given below.

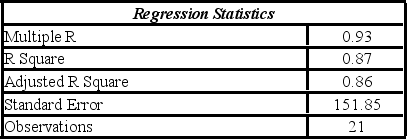

Model AR(1):

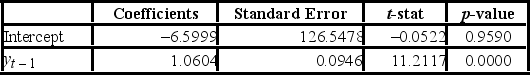

Model AR(2):

Model AR(2):

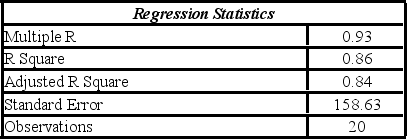

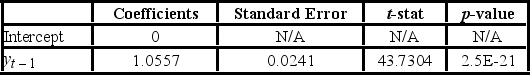

When for AR(1), H0: β0 = 0 is tested against HA: β0 ≠ 0, the p-value of this t test shown the output as 0.9590. This could suggest that the model yt = β1yt-1 + εt might be an alternative to the AR(1) model yt = β0 + β1yt-1 + εt. Partial output for this simplified model is as follows:

When for AR(1), H0: β0 = 0 is tested against HA: β0 ≠ 0, the p-value of this t test shown the output as 0.9590. This could suggest that the model yt = β1yt-1 + εt might be an alternative to the AR(1) model yt = β0 + β1yt-1 + εt. Partial output for this simplified model is as follows:

Find the revenue forecast for 2012 through the use of yt = β1yt-1 + εt.

Find the revenue forecast for 2012 through the use of yt = β1yt-1 + εt.

Correct Answer:

Verified

Correct Answer:

Verified

Q11: The linear trend model, <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6618/.jpg" alt="The

Q12: When a time series is analyzed by

Q13: When comparing which of the following trend

Q14: When the exponential trend model is used

Q15: When comparing polynomial trend models, we use

Q17: In the quadratic trend model, y<sub>t</sub> =

Q18: Ideally, the chosen model is best in

Q19: Which of the following R functions is

Q20: Which of the following is a criticism

Q21: Which of the following is not based