Multiple Choice

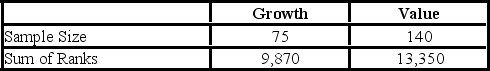

A fund manager wants to know if the annual rate of return is greater for growth stocks (sample 1) than for value stocks (sample 2) . The fund manager collects data on the returns of growth and value funds. Below are the sample sizes and rank sums for the Wilcoxon rank-sum test.  Using the critical value approach and α = 0.01, the appropriate conclusion is ________.

Using the critical value approach and α = 0.01, the appropriate conclusion is ________.

A) reject the null hypothesis; we can conclude the median return of growth stocks is greater than the median return of value stocks

B) do not reject the null hypothesis; we cannot conclude the median return of growth stocks is greater than the median return of value stocks

C) do not reject the null hypothesis; we can conclude the median return of growth stocks is greater than the median return of value stocks

D) reject the null hypothesis; we cannot conclude the median return of growth stocks is greater than the median return of value stocks

Correct Answer:

Verified

Correct Answer:

Verified

Q4: For the Wilcoxon rank-sum test when the

Q5: An energy analyst wants to test if

Q6: A career counselor is comparing the annual

Q7: A research analyst believes that a positive

Q8: The method of runs above and below

Q10: A shipping company believes there is a

Q11: A trading magazine wants to know if

Q12: Investment institutions usually have funds with different

Q13: A pawn shop claims to sell used

Q14: When conducting a hypothesis test for the