Essay

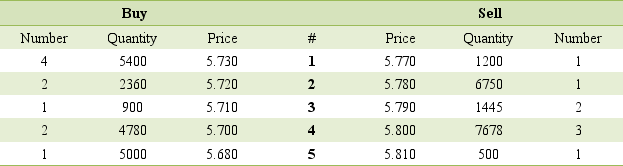

Consider the following market depth information for Fosters Group Ltd:  (a)What would be the outcome if you placed an at-market order to sell 3000 Fosters shares?

(a)What would be the outcome if you placed an at-market order to sell 3000 Fosters shares?

(b)How much would you pay to buy 5000 Fosters shares 'at-market'?

(c)Explain what would happen to the order queue after the transactions in (a)and (b), assuming no other changes.(d)Explain what would happen to your order if you placed an order to sell 1500 Fosters shares at $5.78 (assuming the transactions in (a)and (b)do not take place).

Correct Answer:

Verified

(a)The highest price someone is willing ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q51: Describe the trading and settlement arrangements used

Q52: Identify and briefly explain the competitive pressures

Q53: CFDs are both OTC and exchange-traded.

Q54: List some of the factors for which

Q55: The main investors in Australian shares are

Q57: Which of the following is NOT an

Q58: Chi-X provides Australian retail and wholesale investors

Q59: Companies no longer have to maintain their

Q60: Provide a brief overview of the ASX's

Q61: Market capitalisation is the market value of