Multiple Choice

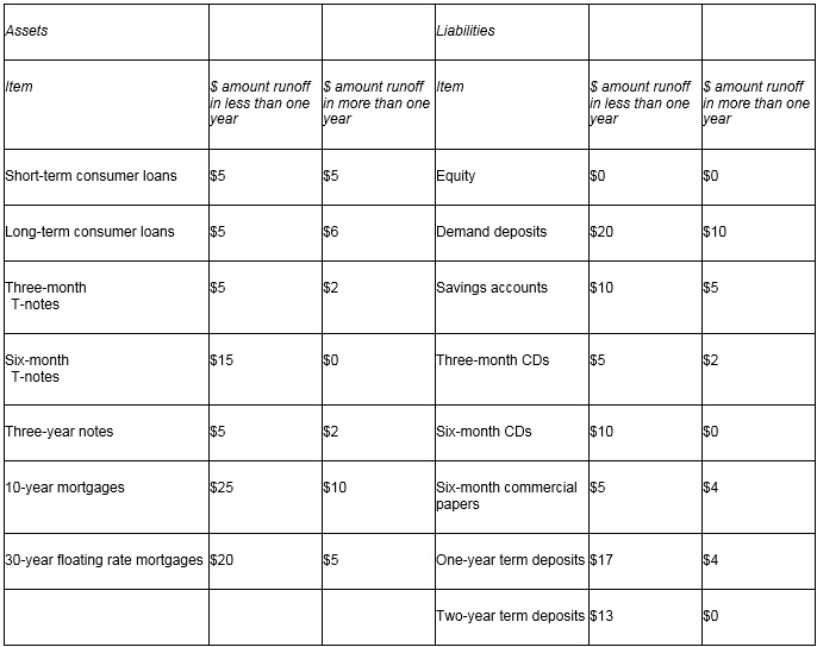

Consider the following table:  How does an increase in the average one-year interest rate of 50 basis points affect the FI's future net interest income?

How does an increase in the average one-year interest rate of 50 basis points affect the FI's future net interest income?

A) The NII will not change.

B) The NII will increase by $50.

C) The NII will increase by $5.

D) The NII will decrease by $50.

Correct Answer:

Verified

Correct Answer:

Verified

Q43: If an FI's repricing gap is less

Q48: Interest rate spread is the difference between

Q49: Which of the following statements is true?<br>A)APRA

Q50: Which of the following statements is false?<br>A)A

Q51: What is meant by the 'runoff' problem

Q53: The bank has a positive repricing gap.Is

Q54: Which of the following statements is true?<br>A)Cheque

Q55: Which of the following statements is true?<br>A)A

Q56: Which of the following is a weakness

Q57: Consider the following repricing buckets and