Multiple Choice

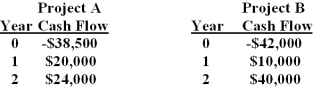

You are considering two independent projects both of which have been assigned a discount rate of 8%.Based on the profitability index, what is your recommendation concerning these projects?

A) You should accept both projects since both of their PIs are positive.

B) You should accept project A since it has the higher PI.

C) You should accept both projects since both of their PIs are greater than 1.

D) You should only accept project B since it has the largest PI and the PI exceeds 1.

E) Neither project is acceptable.

Correct Answer:

Verified

Correct Answer:

Verified

Q16: The internal rate of return (IRR): I.

Q63: List and briefly discuss the advantages and

Q76: Graham and Harvey (2001) found that _

Q87: Matt is analyzing two mutually exclusive

Q88: The discounted payback rule may cause:<br>A)some positive

Q90: The internal rate of return may be

Q92: The Liberty Co. is considering two projects.

Q93: It will cost $2,600 to acquire a

Q96: You are considering an investment with

Q102: The two fatal flaws of the internal