Essay

Adjusting and closing entries

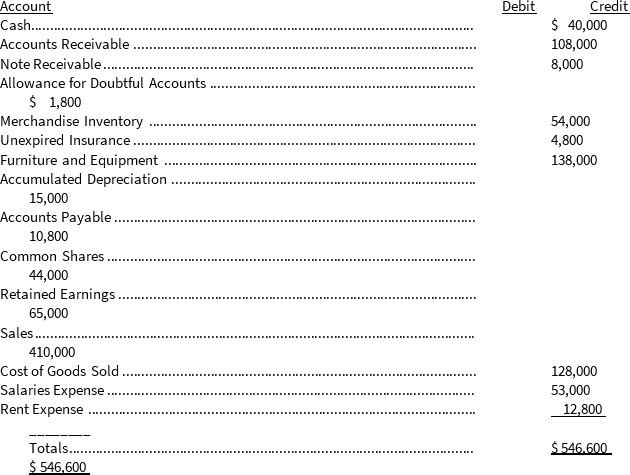

The following trial balance was taken from the books of Kaslo Corporation at December 31, 2020:

At year end, the following items have not yet been recorded.

At year end, the following items have not yet been recorded.

1. Insurance expired during the year, $ 3,000.

2. Estimated bad debts, 1 percent of gross sales.

3. Depreciation on furniture and equipment, 10% per year.

4. Interest at 9% is receivable on the note for one full year.

5. Rent paid in advance at December 31, $ 6,800 (originally debited to expense).

6. Accrued salaries at December 31, $ 6,200.

Instructions

a) Prepare the necessary adjusting entries.

b) Prepare the necessary closing entries.

Correct Answer:

Verified

a) Adjusti...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q12: Type of ownership structure<br>Explain whether the

Q13: Use the following information for the

Q14: On December 1, 2020, Flynn Consulting paid

Q15: An example of a temporary account is<br>A)

Q16: If, during an accounting period, an expense

Q18: On June 1, 2020, Carr Corp. loaned

Q19: An adjusting entry for bad debts will

Q20: On November 1, 2020, Halton Corp. purchased

Q21: On May 15, 2020, Bagle Corp. purchased

Q22: Which of the following is NOT an