Essay

Ten-column work sheet

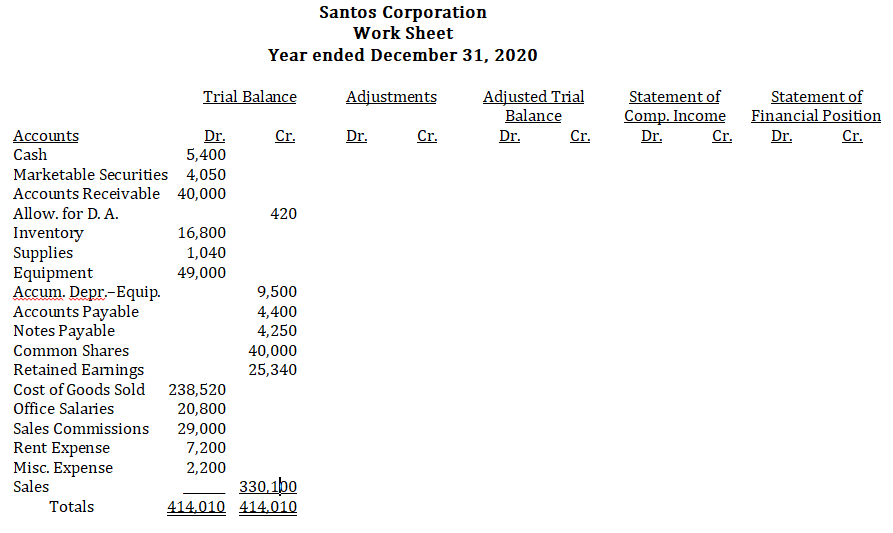

The work sheet and trial balance of Santos Corporation is reproduced below. The information given below is relevant to the preparation of adjusting entries needed to both properly match revenues and expenses for the period and reflect the proper balances in the permanent and temporary accounts.

Instructions

As the accountant for Santos, you are to prepare adjusting entries based on the following data, entering the adjustments on the work sheet and completing the additional columns with respect to the income statement and statement of financial position. Carefully key your adjustments and label all items. (An adjusted trial balance is not required, but is included in the solution.) Round all calculations to the nearest dollar.

(a) After an aging of accounts receivable, it was determined that three percent of the accounts will become uncollectible.

(b) Depreciation is calculated using the straight-line method, with an eight-year life and $ 1,000 residual (salvage) value.

(c) Salesmen are paid commissions of 11% of sales. Commissions on sales for the last week of December have not been paid.

(d) The note was issued on October 1, 2020, with interest at 8%, due Feb. 1, 2021.

(e) A physical inventory of supplies indicated $ 280 of supplies currently on hand.

(f) Provisions of the company's lease contract specify rent payments must be made one month in advance, with monthly payments of $ 900/mo. This provision has been complied with as at Dec. 31, 2020.

Correct Answer:

Verified

Correct Answer:

Verified

Q38: A trial balance<br>A) is a list of

Q39: The salary expense on the 2020 statement

Q40: Adjusting entries<br>Data relating to the balances of

Q41: Rathbone Corp. sells major household appliance

Q42: Principle Place determines that it has NOT

Q44: Marvin holds 10% of the common shares

Q45: Which of the following would NOT be

Q46: Siamese Corp.'s account balances at December 31,

Q47: Use the following information for the

Q48: If the accountant forgets to record an