Essay

The following information has been adapted from the 2004 and 2005 annual reports of Halliburton Company's worldwide operations, available online at

http://ir.halliburton.com/phoenix.zhtml?c=67605&p=irol-irhome

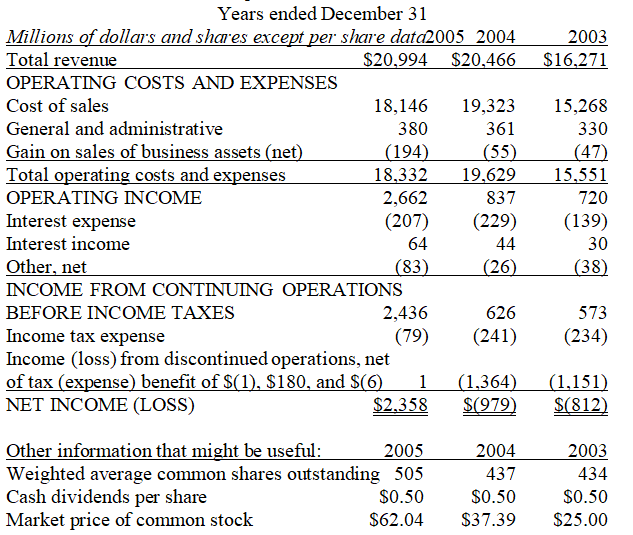

HALLIBURTON COMPANY

Consolidated Statements of Operations

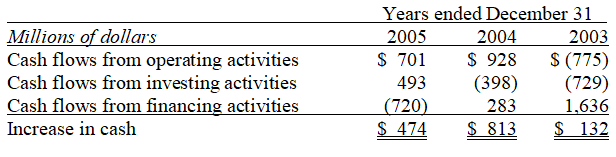

HALLIBURTON COMPANY

Condensed Consolidated Statements of Cash Flows

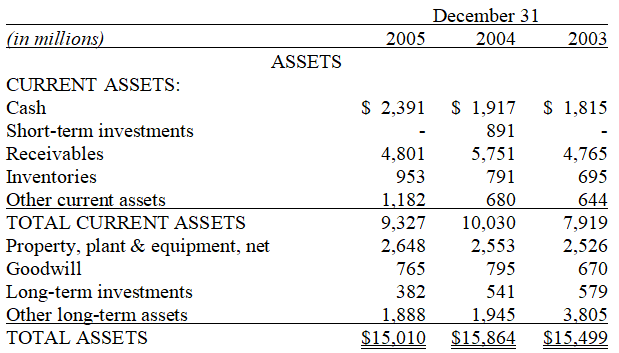

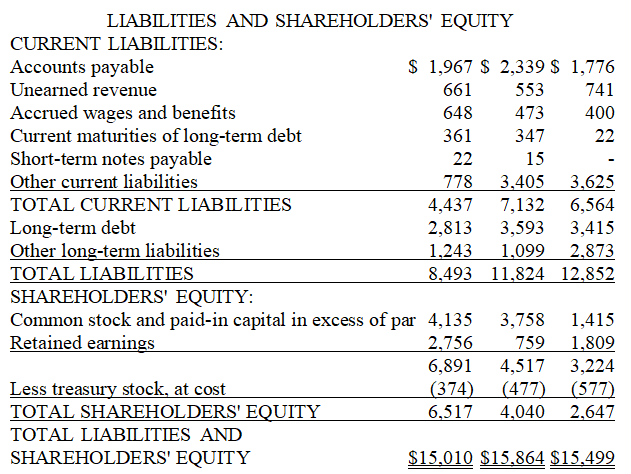

HALLIBURTON COMPANY

Consolidated Balance Sheets

-Divide the class into teams of three or four people.Each team member should work the following problem separately outside of class.Then give the students time in class to compare answers with their teammates and put together a final,correct copy of the problem.Each team should turn in only one copy of the problem for grading.All team members will receive the same grade.

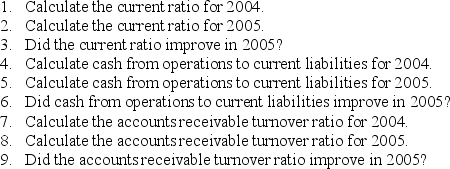

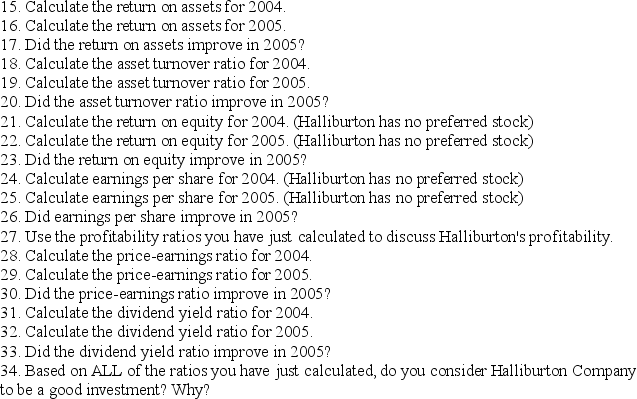

Use the adapted financial statements from Halliburton Company to answer the following questions:

10.Use the liquidity ratios you have just calculated to discuss Halliburton Company's liquidity.

10.Use the liquidity ratios you have just calculated to discuss Halliburton Company's liquidity.

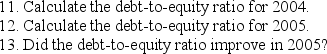

14.Use the solvency ratio you have just calculated to discuss Halliburton Company's solvency.

14.Use the solvency ratio you have just calculated to discuss Halliburton Company's solvency.

Correct Answer:

Verified

1.$10,030 / $7,132 = 1.41

2.$9,327 / $4,...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

2.$9,327 / $4,...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q147: The following information is from Acme's annual

Q148: Comprehensive income is _.<br>A)income earned by a

Q149: The return on equity ratio is a

Q150: One way to diversify is to _.<br>A)invest

Q151: Which financial statement(s)do you need to calculate

Q153: The following information is from Acme's annual

Q154: Owning only stocks is riskier than owning

Q155: The debt-to-equity ratio is a _ ratio.<br>A)liquidity<br>B)solvency<br>C)profitability<br>D)market

Q156: Discontinued operations need to be treated separately

Q157: In horizontal analysis,each item on a balance