Essay

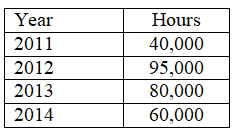

On January 1, 2011, the Peninsula Paper Company purchased manufacturing equipment for $600,000. The equipment has a 4-year estimated useful life and a salvage value of $22,500. The company expects to use the equipment for 275,000 hours. Actual hours the equipment was used are provided in the table below:

Required: Calculate the depreciation expense for each year of the asset's life using:

1. the straight-line method,

2. the double-declining balance method, and

3. the activity (units-of-production) method

Correct Answer:

Verified

1.Straight-line method

_TB547...

_TB547...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q186: On January 1,2011.Hula Hoops,Inc.purchased a $40,000 machine

Q187: All depreciation methods provide the same amount

Q188: Indicate whether each of the following transactions

Q189: A factory machine was purchased on January

Q190: Use the following selected information from ABC

Q192: On January 1,2011,Ace Electronics paid $400,000 cash

Q193: On January 1,2011,Ace Electronics paid $400,000 cash

Q194: Indicate which financial statement would report the

Q195: Which of the following assets should be

Q196: Peterson Company purchased land,building,and equipment for a