Essay

On January 1, 2011, Muddy Acres, Inc. purchased a $44,000 mulching machine with a useful life of 5 years and a $4,000 salvage value. The company uses straight-line depreciation. On December 31, 2014, after 4 full years of use, Muddy Acres sold the machine for $6,000.

Part A: Show the effect of the sale in 2014 on the accounting equation. Write in both the correct dollar amounts and the account titles affected. Use a + for increases and parentheses () for decreases. Assume that depreciation expense for 2014 has already been recorded.

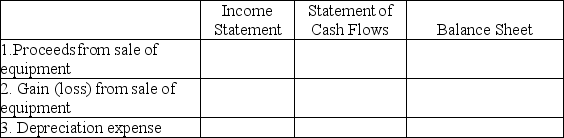

Part B: For each item below,WRITE IN THE AMOUNT as of or for the period ended December 31,2014,in the column of the one financial statement where the amount is found.

Correct Answer:

Verified

Part A:

_...

_...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q195: Which of the following assets should be

Q196: Peterson Company purchased land,building,and equipment for a

Q197: SML International owns an oil field that

Q198: KUI Company owns a copyright with an

Q199: Which of the following statements is TRUE?<br>A)The

Q201: Which of the following assets will NOT

Q202: Describe how to account for a piece

Q203: What basic information must be disclosed about

Q204: Which depreciation method is most similar to

Q205: If an adjusting entry for depreciation is