Short Answer

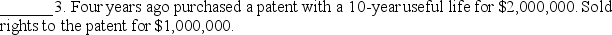

Indicate whether each of the following transactions would result in a gain,a loss,or neither one.

A = Gain

B = Loss

C = Neither a gain nor a loss

______ 2.Bought a machine 9 years ago for $200,000 and over the years recorded $175,000 of depreciation.Sold the machine for $35,000.

______ 2.Bought a machine 9 years ago for $200,000 and over the years recorded $175,000 of depreciation.Sold the machine for $35,000.

______ 4.Recorded $70,000 of depreciation on an asset that originally cost $100,000 and then sold it for a $40,000 note receivable.

______ 4.Recorded $70,000 of depreciation on an asset that originally cost $100,000 and then sold it for a $40,000 note receivable.

______ 5.Bought a machine 5 years ago for $200,000 and over the years recorded $180,000 of depreciation.Sold the machine for $17,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q102: All long-term assets are tangible.

Q103: In an accounting context,cost and expense mean

Q104: Indicate which financial statement would report the

Q105: On January 1,2011,Albatross Shipping Company bought equipment

Q106: Which of the following expenditures should NOT

Q108: On January 1,2012,Orbit,Inc.purchased land and a building

Q109: Put an X in the appropriate box

Q110: A gain on the sale of a

Q111: XYZ Company owns an asset with historical

Q112: A business will have depletion expense only