Essay

Tennyson LTP purchased computers on January 1,2011,at a cost of $120,000.The estimated useful life of the computers is 4 years and there is no estimated salvage value.

Required:

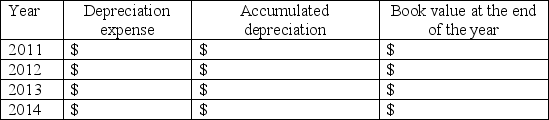

1.Complete the depreciation schedule below assuming Tennyson uses the straight-line method.

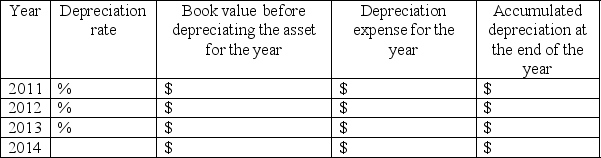

2.Complete the depreciation schedule below assuming Tenison uses the double-declining balance method.

2.Complete the depreciation schedule below assuming Tenison uses the double-declining balance method.

3.Which method would report the greater net income to the shareholders for 2011?

3.Which method would report the greater net income to the shareholders for 2011?

4.Which method results in the higher amount of total depreciation expense over the four-year life of the asset?

Correct Answer:

Verified

1.Straight-line method

_TB5475_00 2.Dou...

_TB5475_00 2.Dou...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q42: How do financial analysts evaluate how well

Q43: A machine was purchased for $100,000 in

Q44: The following information is provided for two

Q45: On January 1, 2011, Keep Trucking, Inc.

Q46: On January 1,2011,Fred McGriff Company bought office

Q48: Put an X in the appropriate box

Q49: Jim wants to post his resume on

Q50: Explain the cost principle.

Q51: A client has asked you to review

Q52: The adjustment to record the use of