Essay

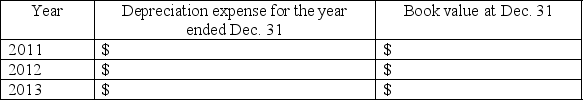

On January 1,2011,Tiler Company purchased equipment that cost $30,000.The equipment has an estimated useful life of 6 years and an estimated salvage value of $3,000.

Required:

1.Using the straight-line method,complete the chart below:

2.Explain why long-term assets must be depreciated.

2.Explain why long-term assets must be depreciated.

3.Explain why land is NOT depreciated while assets such as equipment are depreciated.

Correct Answer:

Verified

1.Depreciation expense for 12 months = (...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q204: Which depreciation method is most similar to

Q205: If an adjusting entry for depreciation is

Q206: Cranberry Company purchased two pieces of equipment

Q207: Which of the following should be recorded

Q208: The Internal Revenue Service requires that a

Q210: Describe the impact on the financial statements

Q211: The management of Omega Co.has decided to

Q212: The following information is provided for two

Q213: On January 1,2011,Ace Electronics paid $400,000 cash

Q214: A loss results when a long-term asset