Essay

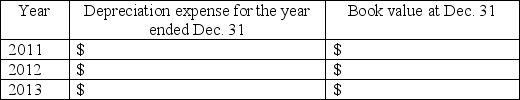

On January 1,2011,Gamma Company purchased equipment that cost $30,000.The equipment has an estimated useful life of 10 years and an estimated salvage value of $5,000.

Required:

1.Use the double-declining balance method to complete the chart below:

2.Explain why long-term assets must be depreciated.

2.Explain why long-term assets must be depreciated.

3.Explain why land is NOT depreciated when assets like equipment are.

Correct Answer:

Verified

1.

_TB5475_00 2.Long-term assets must b...

_TB5475_00 2.Long-term assets must b...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q51: A client has asked you to review

Q52: The adjustment to record the use of

Q53: Use the following selected information from XYZ

Q54: All of the following payments were made

Q55: Which financial statement reports long-term assets?<br>A)the balance

Q57: During 2011,Rob M.Clean Company recorded the following

Q58: On January 1,2011,Ace Electronics paid $400,000 cash

Q59: Use the following selected information from ABC

Q60: BFS Company sold an asset for $7,500

Q61: Cranberry Company purchased two pieces of equipment