Essay

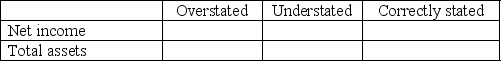

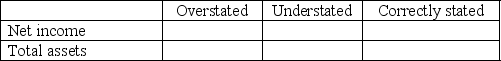

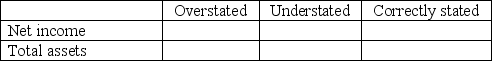

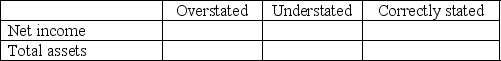

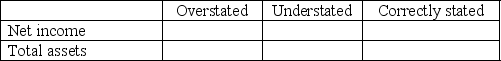

Robin Blind,Inc.recorded the following entries during the year.Put an X in the appropriate box to indicate whether each entry caused net income and total assets to be overstated,understated,or correctly stated.

1.Recorded depreciation for the year using $0 salvage value when the salvage value was expected to be $5,000.

2.Depreciated its airplanes over a life of 35 years,which is 10 years longer than the average life of airplanes.

2.Depreciated its airplanes over a life of 35 years,which is 10 years longer than the average life of airplanes.

3.Recorded ordinary repairs as capital expenditures.

3.Recorded ordinary repairs as capital expenditures.

4.Recorded the purchase of patents as an expense.The purchase should have been capitalized.

4.Recorded the purchase of patents as an expense.The purchase should have been capitalized.

5.Recorded its research and development costs as expenses.

5.Recorded its research and development costs as expenses.

Correct Answer:

Verified

1.Recorded depreciation for the year usi...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q171: Return on assets is a ratio used

Q172: Intangible assets are depleted over their useful

Q173: Use the following selected information from Alpha

Q174: Part A: Record the effect of each

Q175: Identify each of the assets listed below

Q177: On November 1,2011,Frigate Shipping Company bought equipment

Q178: Generally accepted accounting principles are used to

Q179: On January 1,2011,Ace Electronics paid $400,000 cash

Q180: Segregation of duties means that _.<br>A)only the

Q181: Capitalizing a cost means to record the