Essay

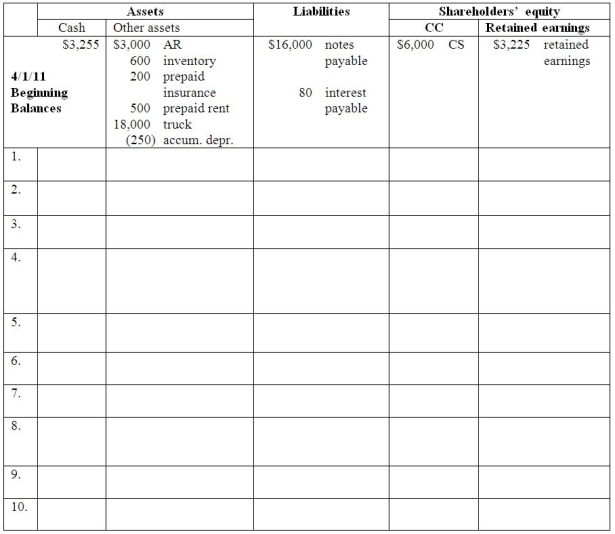

Part A:

Enter the April 2011 transactions and adjustments for Tim's Tams in the accounting equation.

1.April 1 Collected $3,000 of accounts receivable from March sales.

2.April 2 Purchased 1,200 caps @ $6 each on account.

3.April 6 Paid $700 cash for office supplies.

4.April 20 Tim's Tams sold 800 baseball caps @ $10 each on account.Cost of goods sold was $4,800.

5.April 30 Tim's Tams declared and paid a $400 cash dividend to its shareholder.

6.April 30 Adjusted for insurance used during the month.On February 1,Tim's Tams paid $600 for 3 months of insurance coverage that began February 1.

7.April 30 Adjusted for rent used during the month.Last month Tim's Tams paid $1,000 for two months' rent.

8.April 30 Recorded one month's straight-line depreciation on the $18,000 truck that has a 6-year useful life and no salvage value.

9.April 30 Counted the office supplies and found that $200 of supplies have not been used.

10.April 30 Recorded interest on the $16,000,4-month,6% note payable for the month.  Parts B,C,D and E: Complete the financial statements.

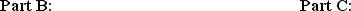

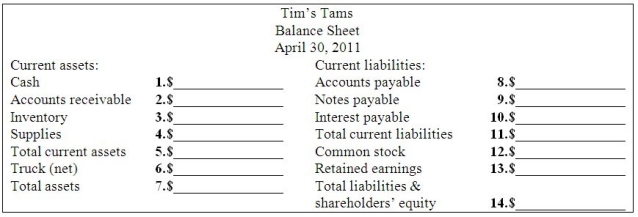

Parts B,C,D and E: Complete the financial statements.

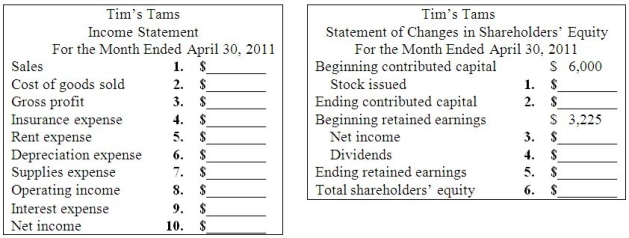

Part D:

Part D:  Part E:

Part E:  Part F: Using the financial statements above,answer the following questions:

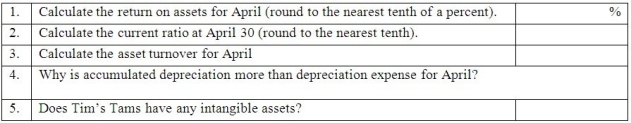

Part F: Using the financial statements above,answer the following questions:

Correct Answer:

Verified

Part A:  _TB5475_00

_TB5475_00  _...

_...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q111: XYZ Company owns an asset with historical

Q112: A business will have depletion expense only

Q113: Use the following code to identify the

Q114: Discuss risks and controls associated with long-term

Q115: Use the following selected information from XYZ

Q117: What is book value and on which

Q118: On January 1,2011,Borba,Inc.purchased a $100,000 machine with

Q119: Under U.S.GAAP,research and development costs (R&D)are not

Q120: Which statement below is TRUE of the

Q121: Required: Put an X in the appropriate